Introduction

In the modern financial world, data is one of the most valuable assets. The ability to read, interpret, and act on financial indicators is crucial for businesses and professionals. Power BI, a business intelligence tool by Microsoft, has become a game-changer in financial analysis, helping organizations monitor key performance indicators (KPIs) and improve decision-making. In this article, we will explore the features of Power BI, how it can be used to enhance financial controls, its role in business growth, and the career opportunities it offers.

What Is Power BI?

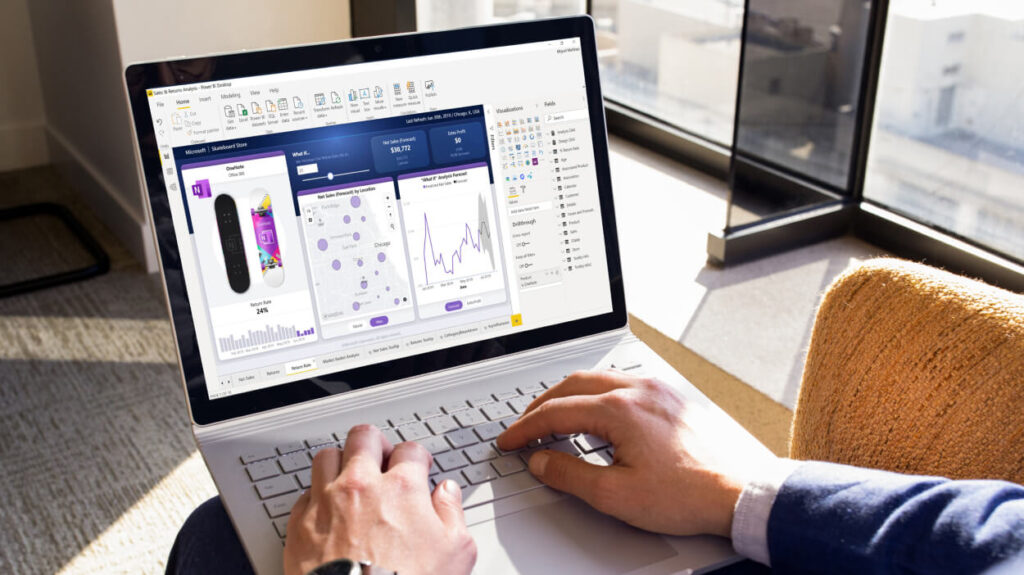

Power BI is a data visualization and business intelligence tool that allows users to connect to various data sources, transform raw data into interactive dashboards, and generate insights through reports. It is widely used by businesses to track financial performance, identify trends, and make data-driven decisions.

Key Features of Power BI for Financial Controls

- Data Integration: Power BI connects to multiple data sources such as Excel, databases, cloud services, and APIs, making it easy to consolidate financial data.

- Real-Time Dashboards: Users can create real-time financial dashboards to monitor revenue, expenses, profitability, and other key metrics.

- Data Transformation: The Power Query tool allows users to clean, shape, and prepare financial data efficiently.

- DAX (Data Analysis Expressions): A powerful language within Power BI that helps create custom financial formulas and calculations.

- Automation: Financial reports can be automated, reducing manual work and ensuring accuracy.

- AI and Machine Learning: Power BI offers AI-powered insights to predict financial trends and identify potential risks.

How Power BI Can Improve Financial Controls

- Better Budgeting and Forecasting: Organizations can create financial forecasts based on historical data and market trends.

- Expense Tracking: Power BI provides detailed insights into business expenses, helping organizations reduce unnecessary costs.

- Revenue Analysis: Businesses can identify their most profitable products, services, and customer segments.

- Compliance and Auditing: The tool helps ensure compliance by tracking financial transactions and detecting anomalies.

- Cash Flow Monitoring: Power BI helps businesses monitor cash flow in real-time, preventing financial crises.

How Power BI Can Be Turned into a Business

- Financial Consulting Services: Professionals who master Power BI can offer consulting services to businesses looking to improve financial analysis.

- Dashboard Development: Companies need customized dashboards to track their financial performance, creating opportunities for Power BI experts.

- Power BI Training: Teaching others how to use Power BI can be a lucrative business, as many companies seek to upskill their employees.

- Data Analytics Firm: Starting a data analytics company that focuses on financial reporting and insights.

- Freelancing: Many businesses hire freelancers to set up and manage their Power BI financial dashboards.

How Large Companies Use Power BI for Financial Metrics

- Google & Microsoft: Use Power BI for financial planning and monitoring cash flow.

- Banks & Financial Institutions: Analyze customer data to improve loan approvals and detect fraud.

- Retail Chains: Track sales performance, expenses, and inventory management.

- Healthcare Industry: Monitor financial transactions and operational costs.

- Manufacturing Companies: Track production costs and profitability.

The Value of Power BI Expertise in the Job Market

Knowing how to use Power BI can significantly enhance career opportunities in finance and data analysis. Some of the key positions that require Power BI skills include:

- Financial Analyst

- Business Intelligence Analyst

- Data Analyst

- Management Consultant

- CFO (Chief Financial Officer) Assistant

- Risk Analyst

- Investment Analyst

Other Tools for Financial Data Control

While Power BI is a leading tool, other solutions also help with financial management:

- Tableau: Another data visualization tool for financial analytics.

- Excel: Still a widely used tool for financial modeling.

- Google Data Studio: A free alternative for creating financial reports.

- QuickBooks: Used for accounting and financial tracking.

- SAP Analytics Cloud: A powerful tool for enterprise-level financial reporting.

The Evolution of Financial Tools and Dashboards

Throughout history, financial analysis has evolved from manual bookkeeping to digital dashboards. Here is how financial tools have progressed:

- Ancient Times: Use of ledgers and simple accounting records.

- 20th Century: Introduction of spreadsheets like Excel.

- 2000s: The rise of enterprise resource planning (ERP) software.

- 2010s-Present: Growth of business intelligence tools like Power BI and AI-powered financial analysis.

- Future: Expected advancements in AI-driven financial predictions and real-time automated reporting.

The Future of Data and Financial Analysis

As technology advances, financial data analysis is expected to become more automated and accurate. Future trends include:

- AI-Powered Financial Insights: Machine learning algorithms will provide more precise financial predictions.

- Blockchain for Finance: Transparent and secure financial tracking.

- Augmented Reality (AR) Dashboards: Interactive data visualization.

- Voice-Controlled Analytics: AI assistants generating financial reports based on voice commands.

- Real-Time Decision Making: Businesses will rely on live financial data for instant decision-making.

How Numbers Translate Results in Business

Numbers tell a story in finance. Some key financial indicators that help businesses measure performance include:

- Revenue and Profit Margins: Indicate business growth.

- Return on Investment (ROI): Shows profitability of investments.

- Cash Flow Statements: Reveal financial stability.

- Debt-to-Equity Ratio: Measures financial risk.

- Customer Acquisition Cost (CAC): Helps optimize marketing spend.

Conclusion

Power BI is a powerful tool for financial analysis, offering real-time insights, automation, and enhanced decision-making capabilities. It is used by businesses of all sizes to track financial performance and improve efficiency. Professionals skilled in Power BI have numerous career opportunities in finance and analytics. As technology continues to evolve, financial tools like Power BI will become even more essential for businesses looking to stay competitive in a data-driven world.

If you’re looking to improve your financial controls or start a career in data analytics, mastering Power BI is a great step toward success.

Leave a Reply